Dupont formula roi

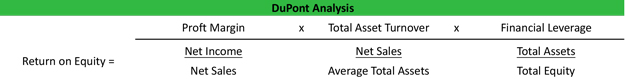

Multiplying the return on sales by the asset turnover. DuPont formula also known as the DuPont analysis DuPont Model DuPont equation or the DuPont method is a method for assessing a companys return on equity ROE breaking.

Analysis Of Profitability Return On Investment In Financial Management Tutorial 22 August 2022 Learn Analysis Of Profitability Return On Investment In Financial Management Tutorial 6339 Wisdom Jobs India

DuPont analysis also known as the DuPont identity DuPont equation DuPont framework DuPont model or the DuPont method is an expression which breaks ROE return on equity into three.

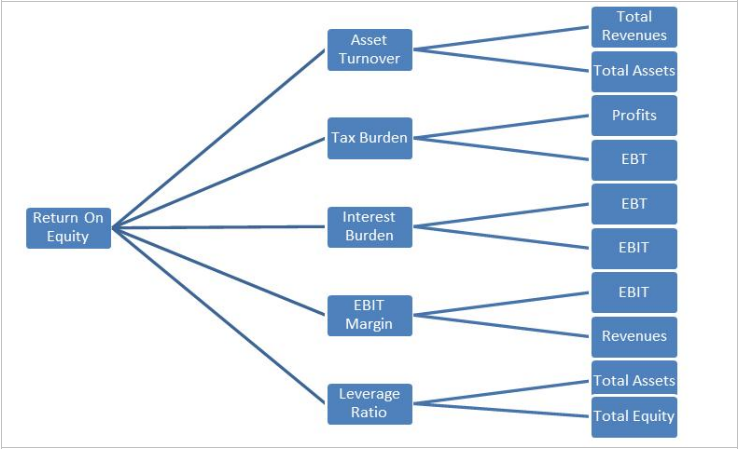

. Return on Equity ROE Tax Burden Asset Turnover Financial. This website may use. The DuPont equation is an expression which breaks return on equity down into three parts.

Nor are many of them familiar with the origins of ROI namely the Du Pont formula created in the early 20th century at the Du Pont powder company in Wilmington Delaware. So I thought Id lay. The basic DuPont Analysis model is a method of breaking down the original equation for ROE into three components.

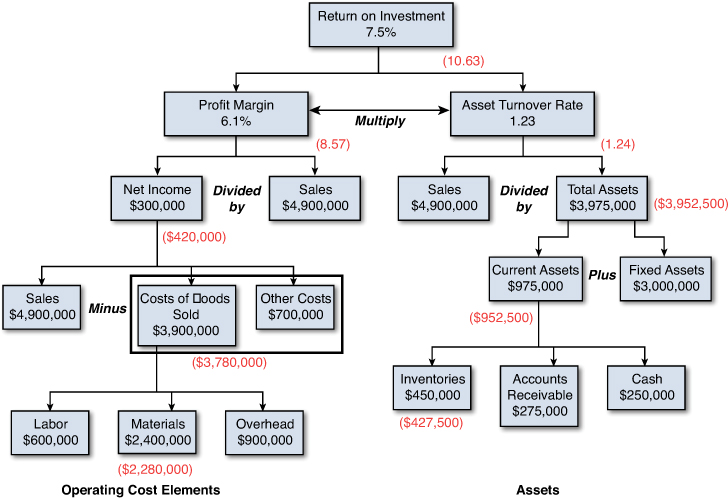

It uses the net profit margin and total asset turnover in the calculation of ROI. The Dupont analysis also called the Dupont model is a financial ratio based on the return on equity ratio that is used to analyze a companys ability to increase its return on. The name comes from the DuPont Corporation which created and implemented this formula into.

The formula for calculating each input is listed on the side while the ROE formula can be seen in the highlighted cells. DuPont analysis is an expression which breaks ROE Return On Equity into three parts. DuPonts analysis formula also known as the DuPont framework or DuPont equation is a useful investing technique to analyze a companys competitivenessIt allows you.

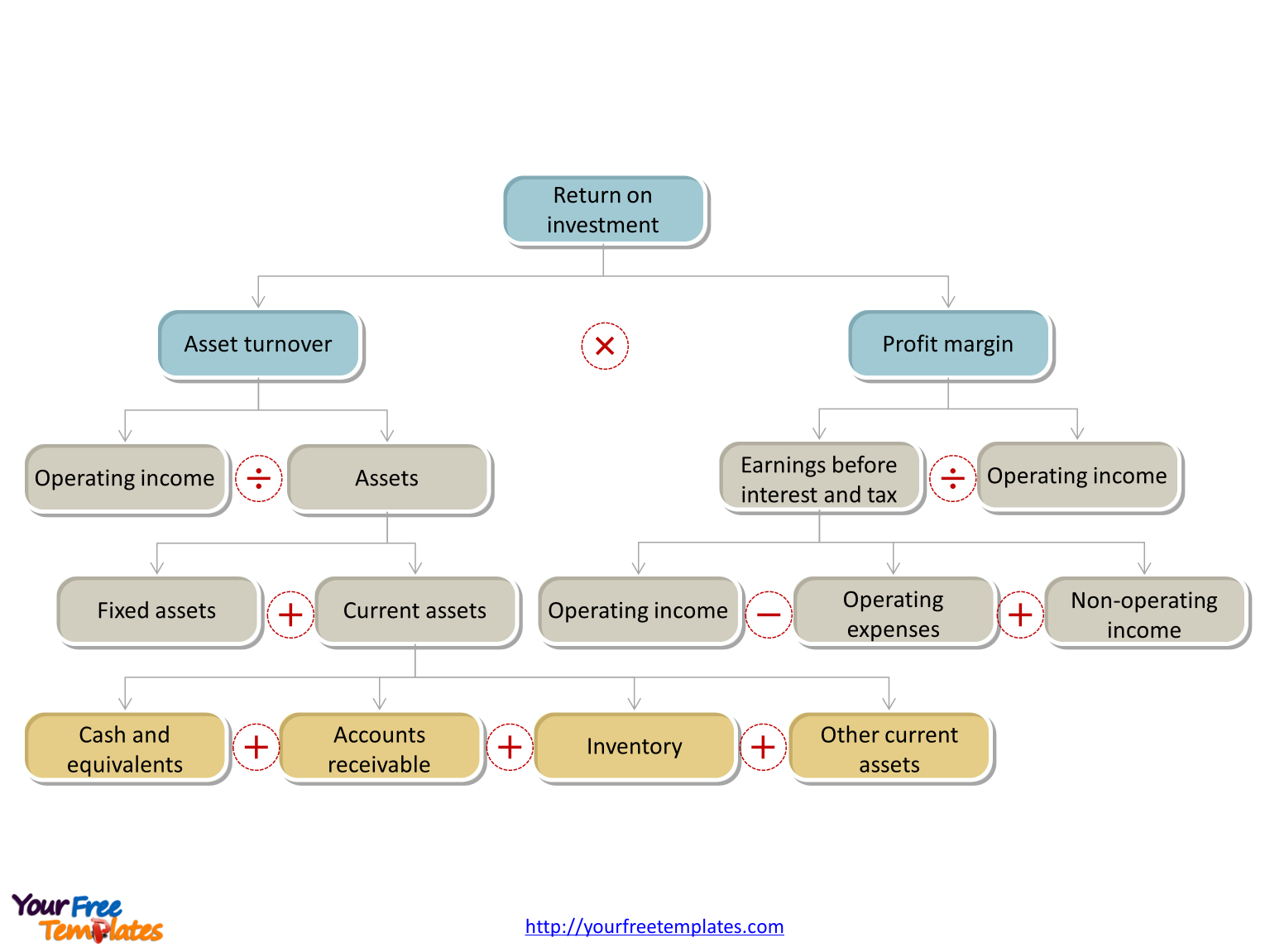

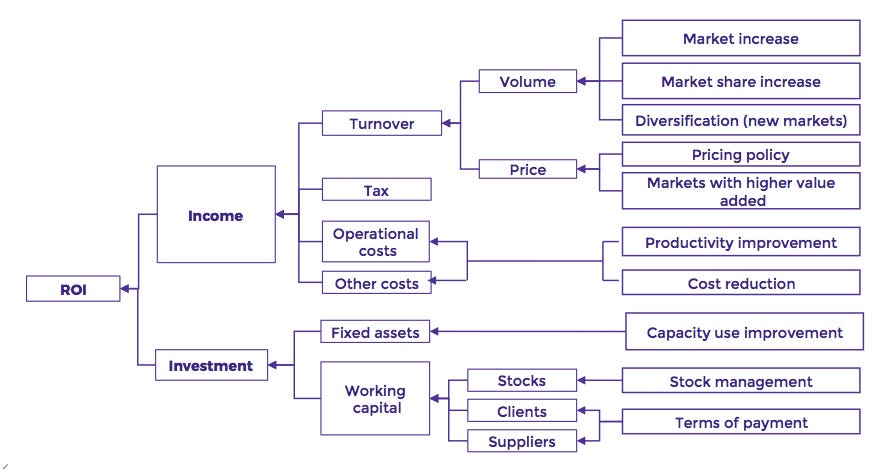

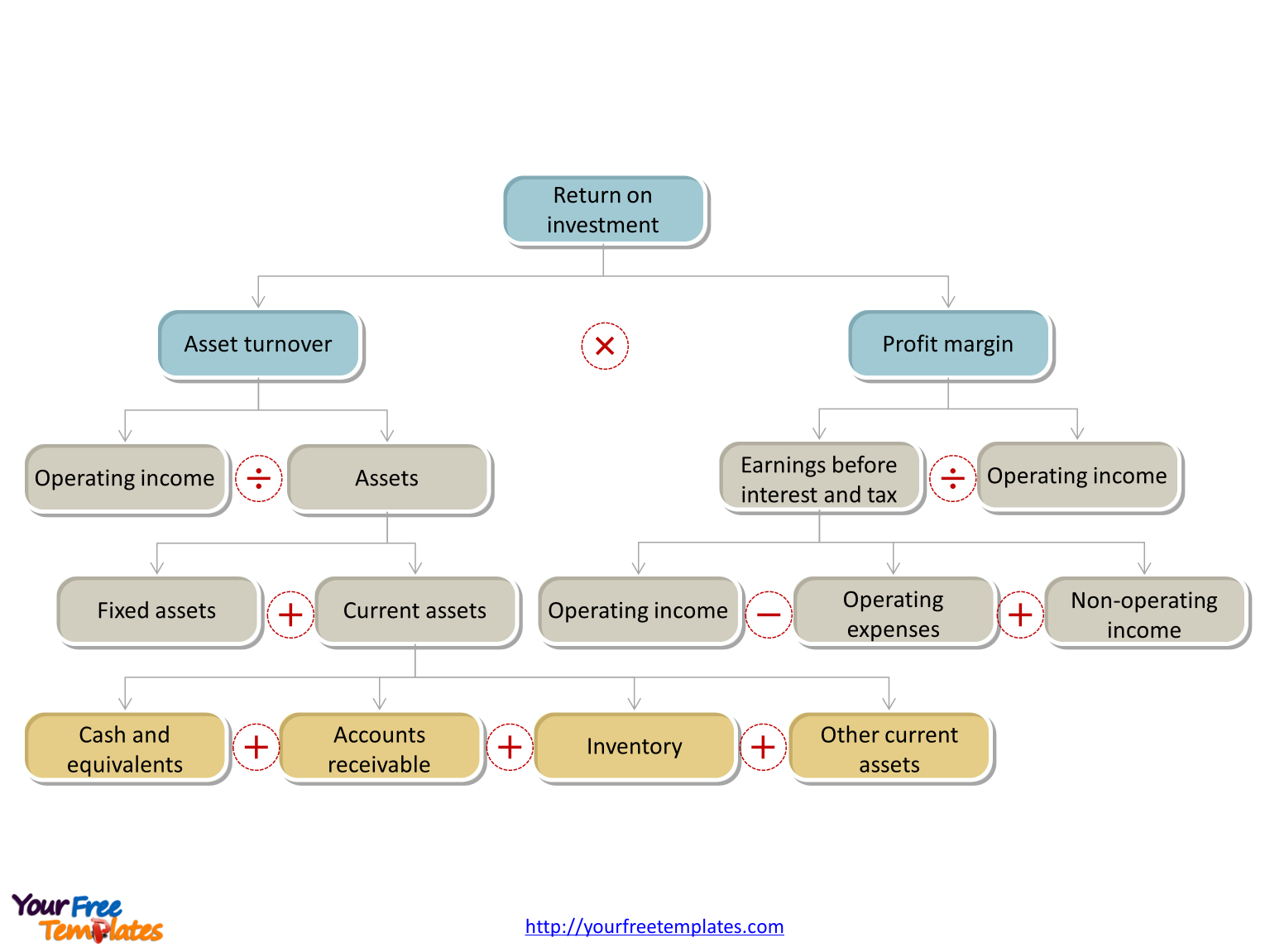

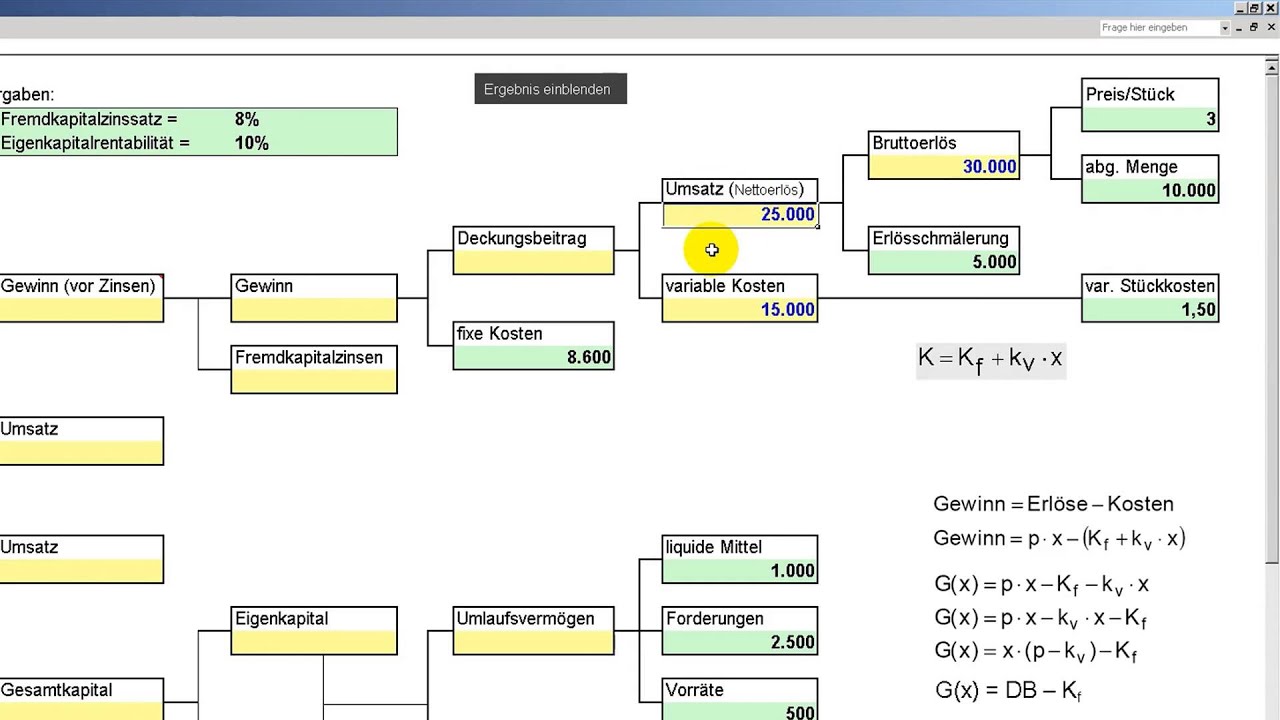

DuPont analysis ROE example. According to the DuPont model your companys ROI is calculated by multiplying its return on sales by its asset turnover. In the 1920s the Dupont company developed a formula that is helpful in understanding how the different ratios from the income statement and balance sheet work together to produce the.

Asset use efficiency 3. Finally the investor uses the figures from each of their previous calculations to calculate each companys return on equity using the DuPont. Operating efficiency asset efficiency and leverage.

Return on Investment ROI can be calculated using the DuPont formula.

Free Dupont Analysis Template Free Powerpoint Template

All About Return On Investment Roi Formula History Pros And Cons

Free Dupont Analysis Template Free Powerpoint Template

Value Creation Opportunities With Data The Revenues Side Louis David Benyayer

Free Dupont Analysis Template Free Powerpoint Template

Purchasing And Supply Management And Return On Investment Roi The Essential Concepts Of Purchasing And Supply Management Informit

Dupont Analysis Formula Example My Accounting Course

The Dupont Roi Model Investing Inventory Sale Back To Work

Financial Engineering Ppt Video Online Download

What Is Dupont Analysis Quora

The Father Of Roi Donaldson Brown

Strengths And Shortfalls Of Dupont Analysis

The Du Pont Return On Investment Formula Johnson And Kaplan 1987 The Download Scientific Diagram

Return On Investment Roi Du Pont Schema Gesamtkapitalrentabilitat Beispiel Youtube

Learning Maps Diagrams And Flowcharts

Dupont Analysis Model مركز البحوث والدراسات متعدد التخصصات

Decoding Dupont Analysis